I have an idea.

If your have a lot of attack martin continuously, you will blow your account.

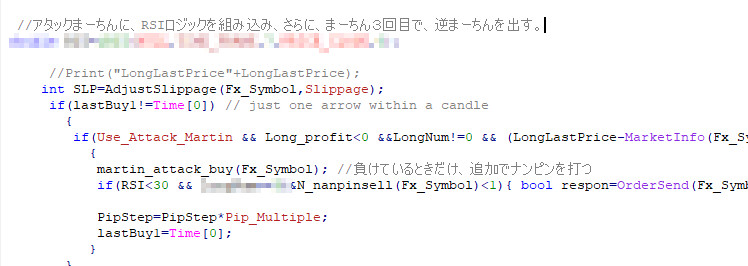

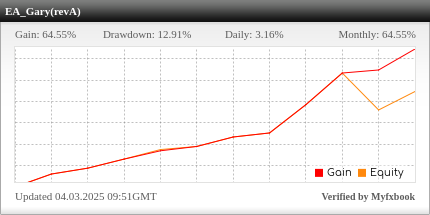

So I tested to add reverse martin code with RSI value condition.

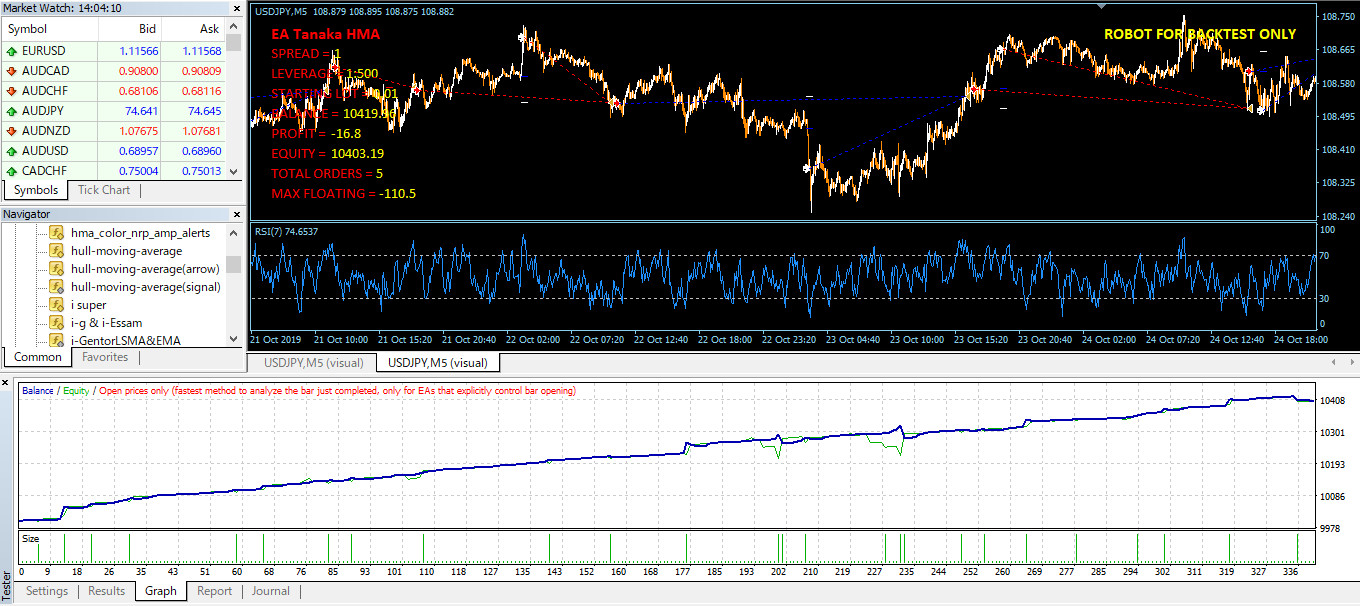

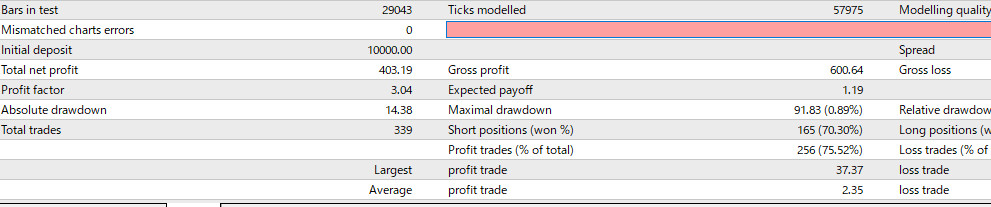

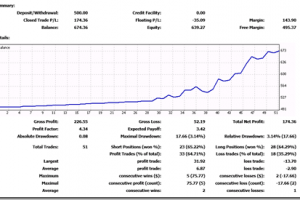

It looks cool? Above fig is USDJPY TF M5

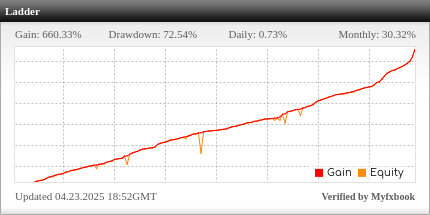

Below fig is EU H1 (attack martin Linear ) Pips distance =40:

But, it is not easy to find the best of attack martin and pips distance parameters.

It depends on currency pair.

713 Downloads

One problem of too many Attack Martins I found is that it keeps placing orders in one direction for a long period without closing some of those latest orders during shot correction of the price pattern. If a couple latest Attack orders have gained profits during price correction, relasing those orders (orders that can take profits) will allow us to re-open Attack orders with the same Attack quota set.

Since there is no trend follow orders placed to recover loss during long series of Attack Martin, I have to use reverse mode to overcome this problem but it might not be an absolute solution. However, the Attack Martin a really good feature.

if active martin is more than 5

Or

if drawdown is more than %50 ;

close all martin orders at 0.382 fibo retracement(This is the safest exit)

(Or could be a submenu and user can select 0.618 fibo retracement for a little risky exit)

i mostly escape from a high risky drawdown with this strategy

____________

P.S : Tanaka you are “the market f.cker” ?