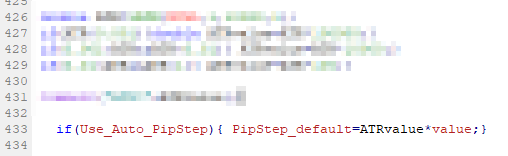

I am just thinking about how I can code pips distance by AUTO.

If the chart is trending , the pips distance is bigger , safer but profit is small.

If the chart is ranging the pips distance is smaller , more profit.

It is better if EA can change pips distance by auto based on ATR value.

I am testing how it works.

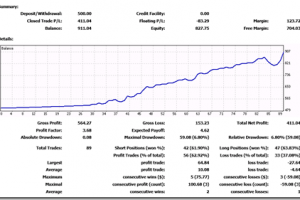

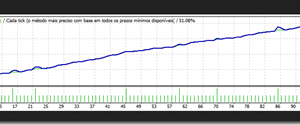

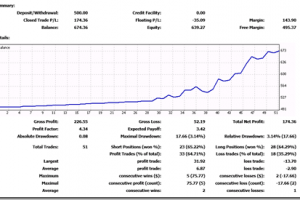

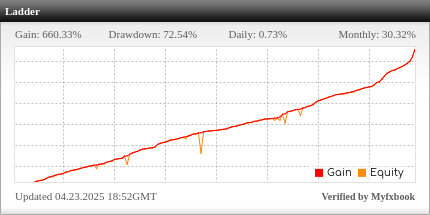

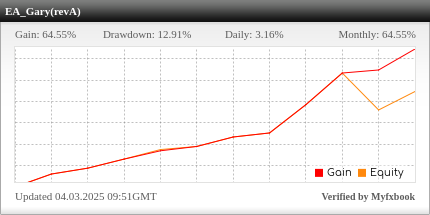

Below picture is backtest result.

But it is no that simple. My research is to be continued…

Totally agreed that pips distance should be automatically adjusted to optimize Attack Martin and trade profits.

Another important factor is the “take profit” value. I found that I need to lower the “take profit value” to minimize draw down because if the “take profit” is too high, orders could not be closed and the EA will keep running Attack Martin until stop out happen.

It would be good if the “take profit” could be automatically reduced to close pending orders when too many Attack Martin detected so we could avoid high draw down and stop out.

How about this?

If you want to minimize take profit, you can use “profit dollar close” instead of take profit.

You put TP=0 & SL=0 , then close with profit dollar.

Sum up all current order lot size and estimate profit dollar by auto and use that value.

What do you think?

Last week I also tested a lot on this parameter.

I found that having only 1 stage setting could not cover various range of fluctuations.

If you can make more than 1 stage such as adding one or two more stages that user can design multiple distance combinations. It will give you more chances to complete attack martin.

For example, the current setting is 1 set of Pip Distance Option:

– PipStep_default xx

– Pip_Multiple x.xx

What you can get is 3 form of Pip Distance Grid:

(1) Constant step grid with Pip_Multiple = 1.0,

(2) Expansion Grid with Pip_Multiple > 1.0, and

(3) Contraction Grid with Pip_Multiple 1.0

this will make constant grid first, then, let 2nd stage grid to expand more when the price trend keep

running in one direction,

– (3) Pip_Multiple#1 = 1.0 and Pip_Multiple#2 1.0 and Pip_Multiple#2 = 1.0 ; expanding 1st, then, go with constant size

– (5) Pip_Multiple#1 > 1.0 and Pip_Multiple#2 1.0 and Pip_Multiple#2 > 1.0 ; using different PipStep_default#1 & #2

– (7) Pip_Multiple#1 < 1.0 and Pip_Multiple#2 = 1.0

– (8) Pip_Multiple#1 < 1.0 and Pip_Multiple#2 < 1.0 ;using different PipStep_default#1 & #2

– (9) Pip_Multiple#1 < 1.0 and Pip_Multiple#2 < 1.0 ;using different PipStep_default#1 & #2

By adding another stage of ==PIP distance== option, you will get more options to test whether which one could run throughout 3-5 years consecutively without facing Stop-Out

Hope this may help.

My previous message was cut by the web system, so it was not full message I wrote.

I may post it again in 2 parts:

(sorry for duplicated comments)

Part#1

Last week I also tested a lot on this parameter.

I found that having only 1 stage setting could not cover various range of fluctuations.

If you can make more than 1 stage such as adding one or two more stages that user can design multiple distance combinations. It will give you more chances to complete attack martin.

For example, the current setting is 1 set of Pip Distance Option:

– PipStep_default xx

– Pip_Multiple x.xx

What you can get is 3 form of Pip Distance Grid:

(1) Constant step grid with Pip_Multiple = 1.0,

(2) Expansion Grid with Pip_Multiple > 1.0, and

(3) Contraction Grid with Pip_Multiple < 1.0

Part#2:

But if you add another stage, let say Pip Distance Option#2

– PipStep_default#2 xx

– Pip_Multiple#2 x.xx

Then you will have more grid formations:

– (1) Pip_Multiple#1 = 1.0 and Pip_Multiple#2 = 1.0

you can design 2 set of constant grids with different size of pip distance in multiple stage which will give

(1a) 1st stage Small Step pip distance; 2nd stage Wide pip distance, or

(1b) 1st stage Wide Range pip distance; 2nd stage Narrow pip distance

– (2) Pip_Multiple#1 = 1.0 and Pip_Multiple#2 > 1.0

this will make constant grid first, then, let 2nd stage grid to expand more when the price trend keep

running in one direction,

– (3) Pip_Multiple#1 = 1.0 and Pip_Multiple#2 1.0 and Pip_Multiple#2 = 1.0 ; expanding 1st, then, go with constant size

– (5) Pip_Multiple#1 > 1.0 and Pip_Multiple#2 1.0 and Pip_Multiple#2 > 1.0 ; using different PipStep_default#1 & #2

– (7) Pip_Multiple#1 < 1.0 and Pip_Multiple#2 = 1.0

– (8) Pip_Multiple#1 < 1.0 and Pip_Multiple#2 < 1.0 ;using different PipStep_default#1 & #2

– (9) Pip_Multiple#1 < 1.0 and Pip_Multiple#2 < 1.0 ;using different PipStep_default#1 & #2

By adding another stage of ==PIP distance== option, you will get more options to test whether which one could run throughout 3-5 years consecutively without facing Stop-Out

Hope this may help.

RG, thanks.

But to code Pip distance matrix, it is not easy. The logic is very complicated.

I prefer much more simple.

Do you have any ideas like Pips distance is made by Auto callulation with ATR value or something?

Or whenever over bought (RSI?) , attack martin sell is activated every time RSI is less than xxxx…..